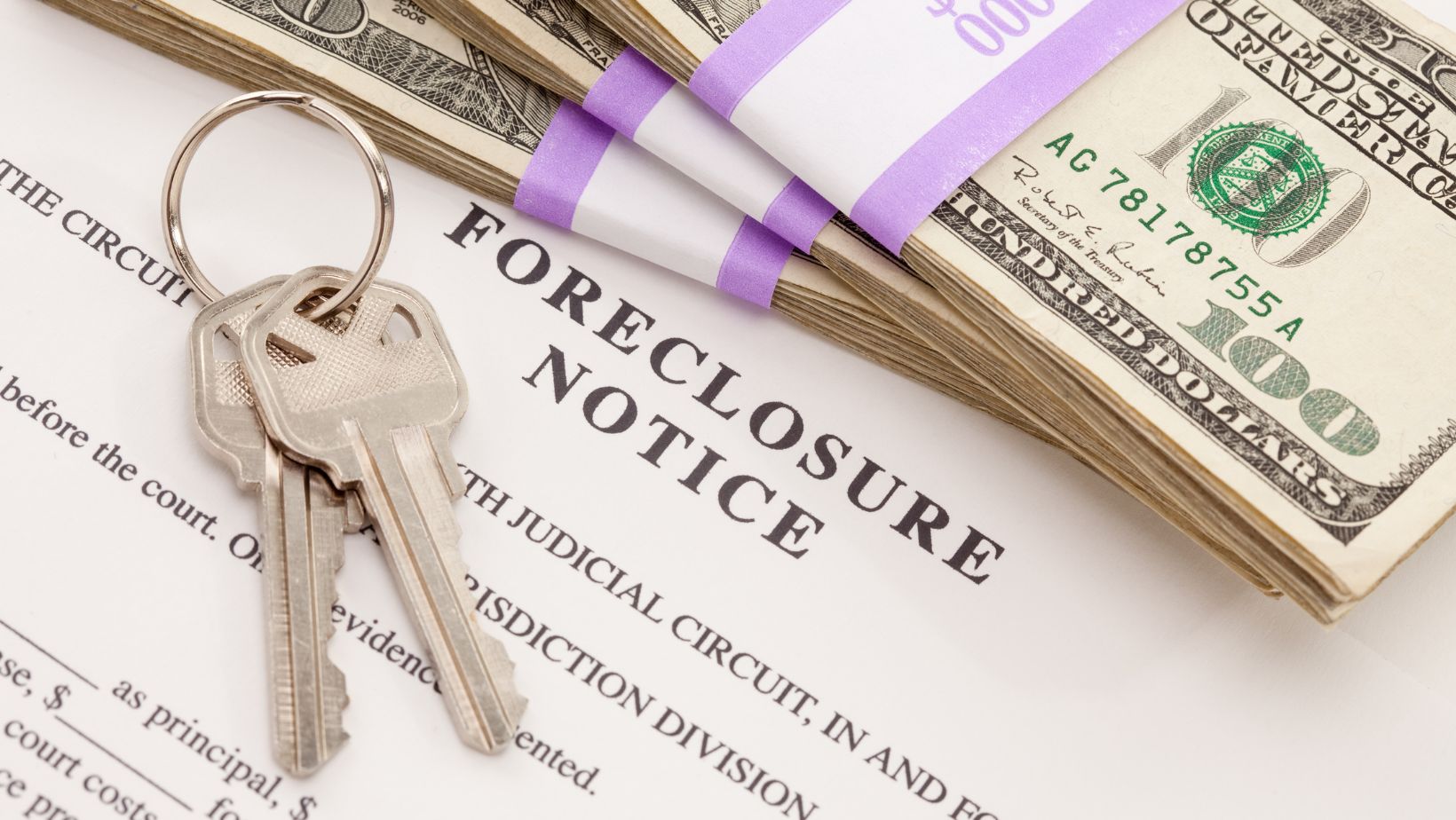

Facing foreclosure is a daunting and stressful situation for any homeowner. The fear of losing your home can be overwhelming, but it’s important to remember that you are not alone, and there are steps you can take to address the problem. You can work towards a solution by understanding your options and taking proactive measures.

Here’s a guide on what to do when you find yourself standing on the brink of property foreclosure.

Understand the Foreclosure Process

Before taking action, you need to understand how foreclosure works. Foreclosure occurs when a homeowner falls behind on their mortgage payments, and the lender begins the legal process to take back the property. This process doesn’t happen overnight; lenders typically send multiple notices before starting foreclosure. Once the process begins, homeowners may still have opportunities to stop it, and acting early gives you more options.

Foreclosure laws vary by state, so it’s critical to research your state’s specific rules. Some states have judicial foreclosures, which require the lender to file a lawsuit, while others allow non-judicial foreclosures, which can be quicker. Understanding your state’s process will help you plan your next steps more effectively.

Communicate With Your Lender Immediately

If you’re struggling to make your mortgage payments, the worst thing you can do is ignore the problem. Lenders generally prefer to avoid foreclosure, as the process is time-consuming and costly for them as well. So, contact your lender and explain your financial situation as soon as possible. Many lenders offer programs to help homeowners get back on track, such as loan modifications, repayment plans, or temporary forbearance.

If traditional options seem out of reach due to a low credit score, you can explore bad credit loans specifically designed for such situations. Loans like Rescue Bucks offer an alternative path, helping borrowers with less-than-perfect credit gain access to emergency funds. These types of loans can provide the immediate relief you need while negotiating a long-term solution with your lender.

A loan modification involves changing the terms of your mortgage, possibly by extending the repayment period or reducing the interest rate. This can lower your monthly payments, making it easier to stay current. Forbearance allows you to temporarily reduce or pause your payments, giving you time to recover financially. Repayment plans, on the other hand, allow you to catch up on missed payments over time.

Explore Government Assistance Programs

There are several government-backed programs designed to help homeowners avoid foreclosure. These programs can offer financial assistance, counseling, and mediation services to help you manage your mortgage and stay in your home. Some options include:

- Federal Housing Administration (FHA) Assistance: If your mortgage is insured by the FHA, you may qualify for special programs like the FHA-HAMP (Home Affordable Modification Program), which helps borrowers reduce their monthly payments.

- Hardest Hit Fund (HHF): This program provides financial assistance to homeowners in states hit hardest by the financial crisis. Depending on where you live, you may be eligible for funding to help pay your mortgage or reduce the principal owed.

- Making Home Affordable (MHA): Though this program officially ended in 2016, some aspects, like HAMP modifications, are still available through individual lenders. Check with your lender to see if you qualify for any relief under these guidelines.

Additionally, contact a HUD-approved housing counselor for free assistance. These counselors can offer advice, help you understand your options, and even negotiate with your lender on your behalf.

Consider Selling the Property

If keeping your home seems impossible, selling it may be a way to avoid foreclosure. You can sell your home outright if you have enough equity, or you may need to consider a short sale if your home is worth less than you owe on the mortgage. In a short sale, the lender agrees to accept less than the full amount owed, allowing you to sell the property and avoid foreclosure.

A short sale can be complicated and may negatively impact your credit, but it’s often a better option than foreclosure. Getting your lender’s approval before proceeding is essential, as they must agree to the reduced payoff. Keep in mind that some lenders may require proof of financial hardship before approving a short sale.

Explore Deed in Lieu of Foreclosure

If you’ve exhausted all other options, a deed in lieu of foreclosure might be a last resort. This process involves voluntarily transferring ownership of your home to the lender in exchange for being released from the mortgage obligation. While it still results in losing your home, it allows you to avoid the foreclosure process and the additional legal and financial consequences that come with it.

A deed in lieu of foreclosure has less impact on your credit than a full foreclosure, but it should only be considered if all other avenues have been explored. You will need to work with your lender to negotiate the terms and ensure they won’t pursue a deficiency judgment, which occurs when the lender seeks to recover the remaining mortgage balance after the property is sold.

Seek Legal Help

Navigating the foreclosure process can be complex, and having legal support can make a significant difference. An experienced foreclosure attorney can help you understand your rights, negotiate with your lender, and potentially find legal defenses that could delay or stop the foreclosure.

If you cannot afford an attorney, consider seeking assistance from legal aid organizations specializing in foreclosure defense. Many states offer free legal services for homeowners facing foreclosure.

Conclusion

Foreclosure is a stressful and challenging experience, but you have options. You can take control of the situation by understanding the process, communicating with your lender, exploring government assistance programs, and seeking legal help. Taking proactive steps early will give you the best chance of keeping your home or finding a resolution to minimize financial damage. The key is not to ignore the problem—reach out for help and take action before it’s too late.