In recent years, the world of cryptocurrency trading has experienced a profound transformation, driven by remarkable progress in artificial intelligence and machine learning technologies. Leading this revolutionary change is the ai trader bot – an advanced algorithmic system that is fundamentally altering our approach to market analysis, strategy implementation, and risk management in the cryptocurrency domain.

These AI-enhanced trading platforms are not merely a step forward from conventional trading instruments. Instead, they represent a complete reimagining of the trading process. By harnessing enormous datasets and employing intricate computational frameworks, these systems can make trading decisions with a speed and level of insight that was once thought impossible.

The Anatomy of an AI Trader Bot

Neural Networks in Trading

At the heart of many advanced AI trader bots lie neural networks, complex systems inspired by the human brain’s structure and function. These networks excel at identifying patterns and making predictions based on vast amounts of data.

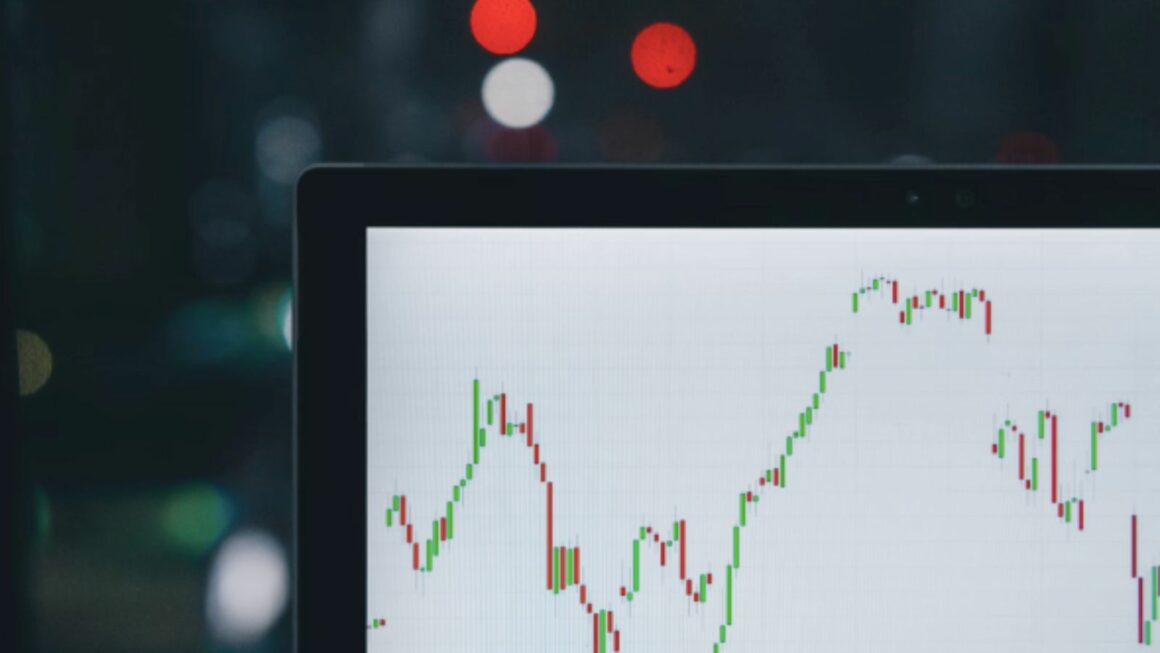

Pattern Recognition in Price Action

Neural networks in AI trader bots are particularly adept at recognizing patterns in price action that might be imperceptible to human traders. For instance, a sophisticated AI bot might identify a complex pattern forming across multiple timeframes in Bitcoin’s price chart, signaling a high-probability trading opportunity. By leveraging AI tools, traders can gain insights that enhance their decision-making processes, potentially leading to more successful trades.

Adaptive Learning from Market Behavior

One of the most powerful features of neural network-based AI trader bots is their ability to adapt and learn from market behavior. Unlike static trading algorithms, these bots can adjust their strategies based on changing market conditions.

A notable example comes from a decentralized exchange, where an AI trader bot using adaptive learning techniques was able to maintain profitability during the extreme market volatility of 2022, while many traditional algorithms faltered.

Natural Language Processing for Market Sentiment

Natural Language Processing (NLP) is another cutting-edge technology employed by advanced AI trader bots to gain a competitive edge in the crypto markets.

Real-Time News Analysis

AI trader bots equipped with NLP capabilities can analyze thousands of news articles and press releases in real-time, extracting relevant information that might impact cryptocurrency prices. This allows for incredibly fast reaction times to market-moving news.

During the 2023 banking crisis, an AI trader bot with advanced NLP capabilities was able to process news about bank failures and adjust its trading strategy for stablecoins within seconds, significantly outperforming human traders.

Social Media Sentiment Extraction

Social media platforms are often leading indicators of market sentiment in the crypto space. AI trader bots use NLP to analyze millions of social media posts, gauging the overall sentiment towards different cryptocurrencies.

Advanced Predictive Capabilities

Time Series Forecasting

Time series forecasting is a critical component of many AI trader bots, allowing them to make predictions about future price movements based on historical data.

LSTM Networks for Price Prediction

Long Short-Term Memory (LSTM) networks, a type of recurrent neural network, are particularly well-suited for time series forecasting in crypto markets. These networks can capture long-term dependencies in price data, making them effective at predicting future trends.

Wavelet Transforms for Trend Identification

Wavelet transforms are a sophisticated mathematical tool used by some cutting-edge AI trader bots to decompose price data into different frequency components. This allows for more accurate identification of underlying trends and cycles in the market.

A team of researchers from a leading technology university demonstrated that an AI trader bot using wavelet transforms could identify major trend reversals in Ethereum’s price with 75% accuracy, significantly outperforming traditional trend indicators.

Anomaly Detection in Market Behavior

Identifying unusual market behavior is crucial for risk management and capitalizing on unique opportunities. Advanced AI trader bots excel in this area through sophisticated anomaly detection techniques.

Unsupervised Learning for Market Regime Changes

Unsupervised learning algorithms allow AI trader bots to detect shifts in market regimes without being explicitly programmed to look for specific patterns. This is particularly valuable in the ever-changing crypto markets.

During the 2022 crypto market downturn, an AI trader bot employing unsupervised learning techniques was able to detect the shift to a bear market several days before most human analysts, allowing its operators to adjust their strategies and mitigate potential losses.

Outlier Detection for Risk Management

AI trader bots use advanced statistical techniques to identify outliers in market data, which can signal potential risks or opportunities.

A cryptocurrency exchange reported that their AI-powered risk management system, which uses outlier detection algorithms, was able to flag and prevent several large-scale market manipulation attempts in 2023, protecting their users from significant losses.

Conclusion

As we’ve explored, AI trader bots represent the cutting edge of cryptocurrency trading technology. From neural networks that can detect subtle market patterns to natural language processing systems that analyze sentiment in real-time, these advanced tools are reshaping the landscape of crypto trading.

The capabilities of AI trader bots extend far beyond what was possible with traditional trading algorithms. They can process vast amounts of data from multiple sources, adapt to changing market conditions, and make split-second decisions based on complex analyses. This has led to improved accuracy in predictions, more efficient trade execution, and better risk management.

However, it’s important to note that the rise of AI in crypto trading also brings new challenges. The increasing use of these sophisticated systems raises questions about market fairness, potential systemic risks, and the evolving role of human traders in an AI-augmented market.

Looking ahead, we can expect AI trader bots to become even more advanced. The integration of quantum computing could lead to unprecedented computational power, while federated learning techniques might allow for collaborative AI models that respect user privacy.

As the crypto markets continue to mature, the synergy between human insight and AI capabilities will likely define successful trading strategies. While AI trader bots offer powerful tools for analysis and execution, human oversight remains crucial for strategy development, risk assessment, and navigating the complex regulatory landscape of cryptocurrency markets.

In conclusion, AI trader bots represent a paradigm shift in how we approach cryptocurrency trading. As these technologies continue to evolve, they will undoubtedly play an increasingly important role in shaping the future of digital asset markets. For traders and investors in the crypto space, understanding and leveraging these cutting-edge tools may well be the key to staying competitive in the years to come.